How Lava Automation Protects Insurance Agency Data

October 23rd, 2025

4 min read

Are you worried about exposing client data when outsourcing insurance tasks?

Do you wonder if a virtual assistant company can truly meet compliance standards?

At Lava Automation, we’ve guided hundreds of agencies through outsourcing while keeping their data secure. Our model is designed to mitigate risk before it reaches your clients, combining secure devices, compliance-first training, and structured oversight.

In this article, you’ll see the safeguards, compliance training, and oversight practices that keep your agency’s data secure while you scale.

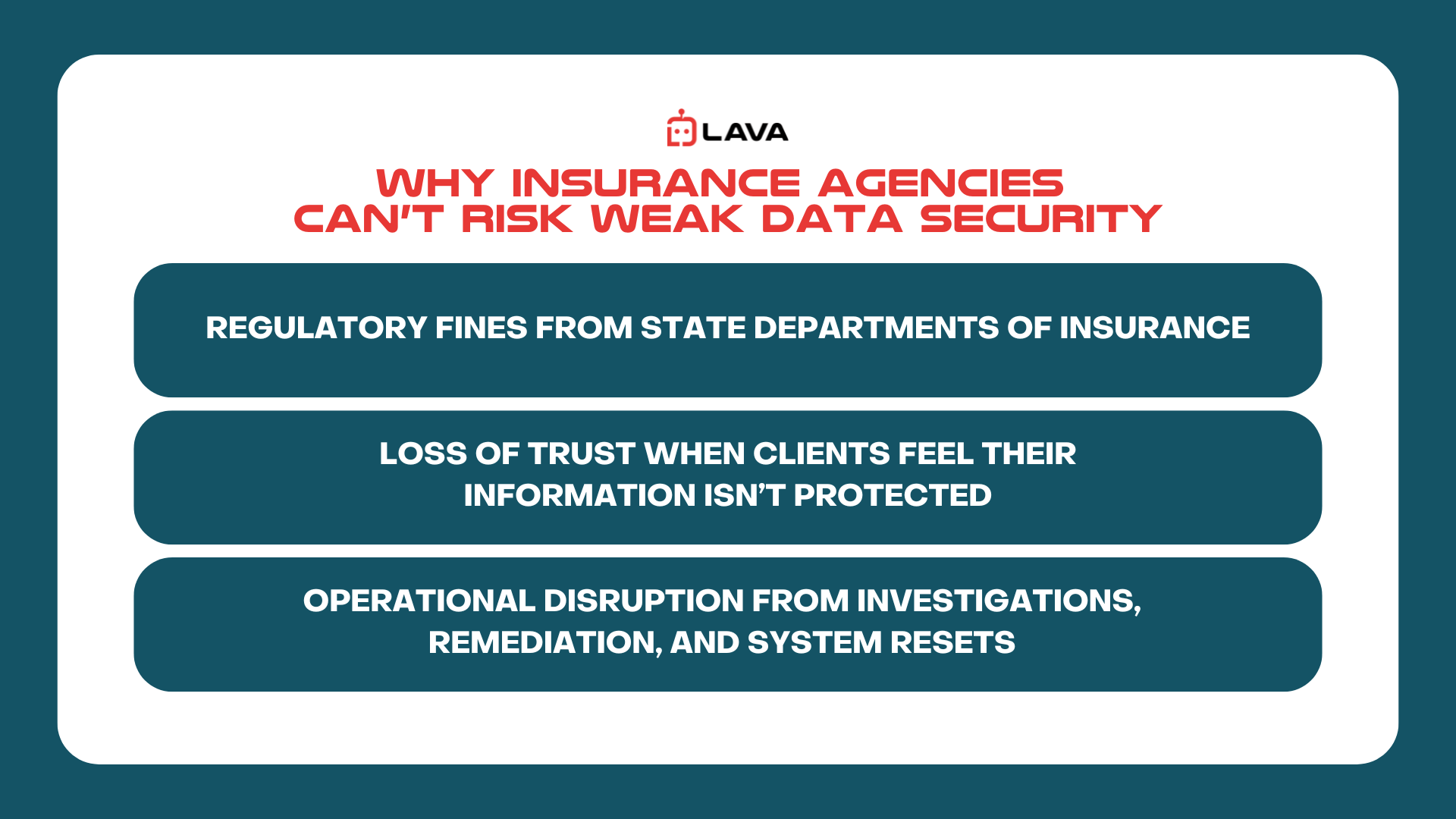

Why Insurance Agencies Can’t Risk Weak Data Security

Insurance agencies work with some of the most sensitive information in business. That includes policy data, personally identifiable information, financial records, and compliance-regulated files.

Even a small error can create large consequences:

Regulatory fines from state Departments of Insurance

Loss of trust when clients feel their information isn’t protected

Operational disruption from investigations, remediation, and system resets

Industry research continues to show that breaches are costly and disruptive. For small and mid-sized agencies, the impact can threaten growth plans or even day-to-day stability.

Security is essential in insurance and forms the foundation of client trust and compliance.

What security protocols does Lava Automation use to protect client data?

Many agencies hesitate to outsource because they worry about assistants using personal devices or unsecured networks. Lava removes that risk by providing a secure environment from day one.

Device provisioning: Every virtual assistant works from a Lava-issued desktop configured with antivirus and monitoring. Personal devices aren’t allowed.

SOC 2-style safeguards: Our controls align with recognized security frameworks. Access is granted by role, tracked, and limited to what work requires.

Restricted networks: Assistants connect through secure LAN line networks to help prevent unauthorized access.

Insurance agencies are common targets for phishing and account takeover attempts because client records hold financial and personal data that criminals value.

Most data breaches aren’t caused by advanced hackers. They usually occur due to simple mistakes, such as using weak passwords or leaving devices unsecured.

Every Lava assistant operates inside a monitored, compliance-ready environment. That reduces exposure from the very first day.

Compliance-First Training for Every Virtual Assistant

Great tools won’t protect data without the right habits. That’s why Lava embeds compliance into training from the very beginning.

Every assistant completes Lava University, a structured onboarding program that includes dedicated compliance modules.

Core elements include:

Insurance-specific boundaries: Clear guidance on what tasks require a license and what unlicensed staff may handle

Data handling protocols: How to process, store, and transfer sensitive information without creating exposure

Role-based access awareness: Why permissions should match tasks and how to escalate when something falls outside scope

Escalation protocols: Steps to follow if a request approaches licensed activity or touches sensitive information

Assistants practice with scenarios they are likely to face inside an agency.

For example, if a client asks a virtual assistant to explain coverage, the assistant knows to stop, document the request, and escalate it to licensed staff. That single handoff protects both compliance and client trust.

Training continues after initial onboarding with refreshers and coaching, so assistants stay aligned as systems and requirements evolve.

Security habits aren’t left to chance. Lava reinforces them with training through daily practice.

How do agencies maintain control and oversight when outsourcing with Lava?

A common fear with outsourcing is losing control. Agencies worry that a provider might create shadow accounts or limit visibility.

Lava addresses this with clear guardrails:

Agency-owned systems: Your AMS, CRM, phone system, and tools remain under your license and ownership.

Operational visibility: You can review activity and work outputs through your systems and agreed reporting.

Contractual safeguards: Data belongs to you. Our agreements spell out ownership and responsibilities.

The difference becomes clear when you compare this with models where providers create and control assistant accounts. If the vendor owns credentials, you risk losing access, inheriting unmonitored accounts, or facing uncertainty about where your data is stored. With Lava, the agency keeps authority, access, and control.

You keep the keys. Lava provides the guardrails.

The Business Impact of Secure Virtual Assistant Support

When security is built into the workflow, agencies lower their risk while creating space for growth.

Common outcomes include:

Faster onboarding: Assistants start in a secure, ready-to-work environment

Fewer audit issues: Clear boundaries and training help prevent compliance missteps

Confident delegation: Leaders hand off unlicensed tasks without second-guessing data exposure

Better client experience: Licensed staff focus on advising and selling while assistants manage secure back-office work

Agencies that commit to security-first outsourcing gain peace of mind along with a structure that keeps licensed staff focused on high-value activities. Within this framework, assistants contribute efficiently while the agency scales safely.

See Why Agencies Trust Lava With Their Most Sensitive Data

Every agency owner has hesitated to outsource because of data security concerns. In insurance, even one mistake can damage trust and trigger costly cleanup.

That’s why Lava Automation builds security into every layer of our service. From locked devices and enterprise-level safeguards to structured compliance training, we’ve designed our model so you can grow without second-guessing whether your data is protected.

When agencies know their information is safe, they delegate with confidence. Licensed staff stay focused on advising and selling while virtual assistants handle back-office workflows inside a secure environment. The result is secure onboarding, fewer compliance headaches, and peace of mind that growth won’t come at the expense of safety.

Agencies that build secure systems today also prepare themselves for tomorrow. Strong controls make it easier to adapt to future compliance changes, client expectations around digital trust, and the coming wave of AI-driven tools.

If you’ve been waiting to explore outsourcing until you felt sure about data protection, now is the time. Book a demo with Lava Automation today and see how our secure approach helps your agency scale with confidence.

Frequently Asked Questions

How does Lava’s security compare with hiring direct?

Direct hires often rely on personal devices and ad-hoc onboarding. Lava uses provisioned devices, role-based access, and compliance training from the start.

Can virtual assistants access client payment details?

Access to payment systems and sensitive financial data is controlled by the agency. Lava follows least-privilege principles and encourages agencies to limit access to what the role requires.

What makes Lava’s security model different from other providers?

Many providers leave onboarding and compliance to the agency. Lava supplies secure desktops, recognized safeguards, structured training, and active oversight so you aren’t left exposed.