How a Virtual Assistant for Insurance Agents Strengthens Productivity Inside Your Agency

May 7th, 2024

4 min read

Do you feel stretched between service work, client communication, and ongoing documentation demands? Are routine tasks pulling your focus away from advising clients and moving accounts forward?

Insurance agencies often reach this point when internal processes grow faster than available time. Work piles up. Messages wait longer for replies. Systems rely heavily on memory. Many teams experience this even when they work with strong effort and clear intention.

At Lava Automation, we have supported hundreds of agencies as they create structure in their operations through virtual assistant support and automation. With billions in premium supported across our systems, we understand why agencies search for ways to regain time and create predictable workflows.

A virtual assistant for insurance agents supports daily operations by handling routine tasks, strengthening follow-through, and supporting the systems your team uses. This article explains why agencies consider a virtual assistant, which tasks create steady productivity gains, and how to integrate support inside your structure.

What Does a Virtual Assistant for Insurance Agents Actually Do?

A virtual assistant supports daily operations through documented administrative and service-related tasks. The role adapts to your systems, your communication expectations, and your agency’s established workflow patterns. Each task reflects how your agency already works.

A virtual assistant becomes effective when responsibilities follow clear steps within your environment. Skill develops through examples, guidance, and alignment with your expectations.

Which administrative tasks should insurance agencies delegate first?

Administrative tasks repeat throughout the day and interrupt focused work. Many agencies begin by handing off tasks such as:

Email organization

Appointment scheduling

Client data updates

Document preparation

Routine follow-ups

Delegating these tasks frees hours that often disappear in small increments throughout the day.

How does a virtual assistant support daily service work?

Insurance agencies depend on movement across renewals, certificates, endorsements, and supporting documentation. A virtual assistant supports this movement by:

Monitoring shared inboxes

Tracking follow-ups

Preparing standard documents

Gathering supporting information

These responsibilities help licensed staff remain focused on client conversations and policy decisions.

How does personalized support differ from automation?

Automation completes tasks that follow a defined workflow. A virtual assistant supports tasks that require context, interpretation, or human judgment.

This combination helps your workflows progress consistently and reduces stalled work.

How Does a Virtual Assistant Support Daily Productivity?

Productivity stabilizes when routine tasks follow a consistent structure. A virtual assistant reinforces that structure by supporting movement, reducing delays, and strengthening communication across your agency.

Progress becomes steadier when routine responsibilities no longer depend on available moments in your team’s schedule.

How does a virtual assistant create available time for your team?

Interruptions can disrupt work that requires focus. A virtual assistant creates available time by managing:

Inbox activity

Document collection

Carrier portal updates

CRM task creation

When routine work moves forward without constant attention, your team can remain present with client needs.

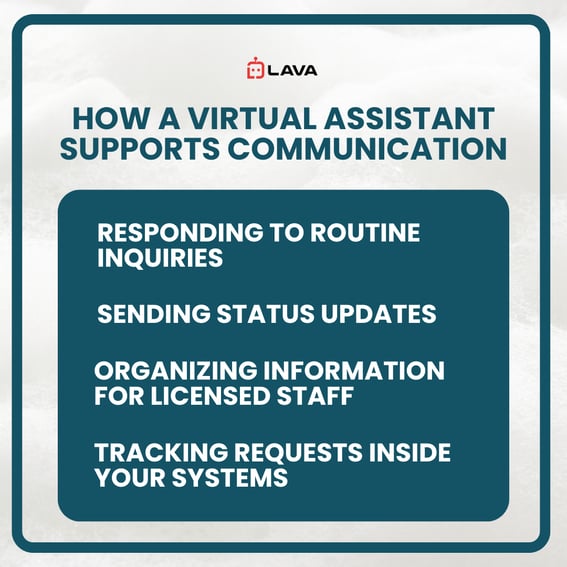

How does a virtual assistant support client communication?

Clients notice timing, clarity, and follow-through. They value updates that acknowledge requests and outline next steps.

A virtual assistant supports communication by:

Responding to routine inquiries

Sending status updates

Organizing information for licensed staff

Tracking requests inside your systems

Reliable communication supports client confidence and reduces confusion.

How does a virtual assistant address staffing pressure?

Hiring full-time local staff requires salary, benefits, onboarding, and physical space. Many agencies look for support that fits within existing structures.

A virtual assistant absorbs routine work without requiring changes to internal staffing models.

How Does a Virtual Assistant Fit Into Your Hiring Options?

Hiring full-time employees includes salary, benefits, equipment, onboarding, and workspace. These obligations can delay hiring even when support is needed.

A virtual assistant supports your agency through task-based or hourly work. Agencies pay for the help they need when the need appears, which keeps the workload more manageable.

A virtual assistant adds capacity without creating additional ongoing obligations.

How Can Insurance Agencies Integrate a Virtual Assistant Successfully?

A virtual assistant becomes effective when your agency provides clarity, structure, and early alignment. Agencies see steady results when they introduce tasks gradually and provide consistent examples.

If you want to understand how training develops, read How Lava Automation Handles Virtual Assistant Training before assigning responsibilities.

Which tasks should you delegate first?

Choose tasks that follow documented steps and do not require licensing. If your team can explain a task with examples, a virtual assistant can learn it.

Starting with clear tasks builds early momentum and consistent results.

What tools support collaboration with a virtual assistant?

A virtual assistant works inside your existing systems, including:

Communication platforms

CRMs and AMS tools

Shared file directories

Workflow documentation

Shared systems create steady alignment and ensure the assistant participates in daily movement.

How should training and communication work?

Training guides accuracy and consistency. A virtual assistant learns your standards through examples, feedback, and clear explanations. Regular check-ins help uncover gaps and support reliable work.

Training builds dependable outcomes, and communication keeps expectations aligned.

Integration Checklist for a Virtual Assistant Inside an Insurance Agency

Define goals

Choose tasks that follow documented steps.

Prepare system access

Provide examples

Set update routines

Track progress inside your systems.

Review performance regularly

Each step supports smooth integration and dependable performance.

Is a Virtual Assistant the Right Next Step for Your Agency?

Many agencies reach a point where capacity feels limited and daily work begins to feel reactive. Communication, follow-through, and workflow timing become difficult to sustain.

A virtual assistant introduces structure to routine tasks, so your team can operate with steadier focus and fewer interruptions. This shift supports smoother service and more predictable progress.

These improvements develop when expectations are clear and training is intentional. With the right systems in place, a virtual assistant becomes part of your daily operations. At Lava Automation, we have supported hundreds of agencies through this transition. With billions in premium supported and thousands of hours returned to insurance teams, we understand how structure, clarity, and coaching support a reliable working relationship.

Your next step is to read How Experienced Will My Virtual Assistant Be? to see how readiness develops during onboarding and how your assistant becomes a steady part of your workflow.

Frequently Asked Questions

How long before a virtual assistant becomes productive?

Many assistants begin producing consistent work within 30 to 60 days when tasks are clearly defined and supported with examples.

Which tasks should insurance agencies delegate first?

Start with documented, repeatable tasks such as inbox monitoring, data updates, follow-ups, and renewal preparation. These tasks build early traction and reduce daily interruptions.

Does a virtual assistant need insurance experience before starting?

A virtual assistant does not arrive pre-trained. Skill develops through structured training inside your systems.

How much oversight is required during the first month?

Plan for steady check-ins and feedback. Agencies that invest time early see predictable accuracy and earlier independence.

Is a virtual assistant secure enough for client and policy data?

Yes. Assistants working inside SOC 2 compliant systems with secure devices, monitored access, and documented workflows maintain the required protections.

Topics: